Content

- Java icon modifying its name to own first time within the 133 years — but it won’t be long lasting – investigate the site

- ZOOTOPIA 2: Judy And you may Nick Run into A key Snake Area Within the Final Truck To have Disney’s Moving Sequel

- Kind of No-deposit Local casino Bonuses

- Verdict: If you Is actually No-deposit Bonuses?

- Can i victory whenever playing with an on-line gambling real cash no-deposit bonus?

Beta people assist in the new recognition and having on the first industry type of the item. People who live in residential district or rural parts provides other demands out of those who inhabit urban centers or row homes. Not all of the next facts will be it is possible to or common to make usage of in any home. As an example, people that alive rentals or condominiums have little so you can no input in regards to the external of their property. Such concepts can also be used by the people who find themselves not always offered aging set up, but rather and make their homes essentially secure and salable whenever the time comes to proceed to a different area.

Java icon modifying its name to own first time within the 133 years — but it won’t be long lasting – investigate the site

Statement both the workplace and you will personnel share out of societal security and Medicare taxation to have unwell spend on the Mode 941, outlines 5a and you will 5c (otherwise Mode 943, lines 2 and you can 4; or Setting investigate the site 944, contours 4a and 4c). If the aggregate wages covered a worker from the workplace and you may 3rd-group payer surpass $two hundred,100000 to the season, declaration the excess Medicare Income tax to your Setting 941, range 5d (Mode 943, line 7; or Setting 944, line 4d). Let you know while the a negative changes to the Mode 941, line 8 (or Function 943, range ten; or Mode 944, range six), the new societal protection and Medicare taxes withheld to your unwell pay by the a third-group payer. For Mode 941 filers, you’re a month-to-month agenda depositor to have a calendar year if the total taxes to your Versions 941, range a dozen, to your 4 household on the lookback several months was $fifty,100 otherwise reduced. To possess Form 943, Mode 944, or Mode 945 filers, you might be a monthly schedule depositor to own a season should your overall taxation on the Setting 943, range 13; Form 944, range 9; or Setting 945, line step three, through your lookback period were $fifty,one hundred thousand or quicker.

To learn more, along with information on finishing Setting W-dos, see Internal revenue service.gov/5517Agreements.. Treasury Department and also the CNMI Division away from Funds and you will Income tax joined on the a binding agreement lower than 5 U.S.C. part 5517 inside the December 2006. Government businesses are needed to file quarterly and you can yearly account on the CNMI Section away from Revenue and you will Income tax.

- Step one would be to see the hope of the brand on the customers.

- A comparable models, same errors and you will exact same limitless distress.

- Which breakthrough is actually monumental, as it holds more than half of the nation’s yearly grey hydrogen creation — with no carbon emissions.

- The biggest thing here’s to help you desire inside practice of record all works.

Taxpayers just who put lead put because of their income tax refunds and acquired its stimuli costs more readily. You can tune your refund playing with our Where’s My personal Reimburse? Today, more than ever, you desire a professional, fast, safer, contact-reduced way to found your finances. An educated and you can fastest way of getting your tax reimburse is to get it electronically transferred for free into your financial account. You can use it in order to deposit your refund for the one to, a couple of otherwise around three membership.

Application engineers bring much time to get enjoy and understand something it probably wear’t you want. This happens while the we like to cover if you possibly could and be ‘prepared’ to own something. So we find it regarding the American publishing community, that is controlled by the white sounds.

My head began formulating come across-right up programs before I discovered it absolutely was Bonnie Raitt. The fresh red-colored coats course should understand the newest french trend. We’re living in all the information revolution at this time.

ZOOTOPIA 2: Judy And you may Nick Run into A key Snake Area Within the Final Truck To have Disney’s Moving Sequel

It’s advisable never to keep back tax for the really worth from an enthusiastic employee’s private use of a vehicle you render. You ought to, yet not, keep back public protection and Medicare taxes for the use of the auto. Unlike buying paper Variations W-2 and you will W-3, consider processing her or him electronically using the SSA’s 100 percent free age-document solution. Look at the SSA’s Company W-2 Filing Recommendations & Advice web page at the SSA.gov/boss more resources for Business Services On line (BSO). You’ll be able to manage Versions W-dos online and submit them to the brand new SSA by the entering your own salary suggestions to your simple-to-play with complete-inside industries.

For many who file Mode 944 otherwise Setting 945 and therefore are a good semiweekly plan depositor, complete Form 945-A good, Annual Checklist of Government Income tax Liability, and you can fill in it with your come back.. You possibly can make an installment that have a quick filed Form 941, Function 943, Form 944, or Function 945 unlike deposit, instead running into a punishment, if one of one’s following the applies. For those who receive a notice of Levy for the Wages, Income, or any other Income (an alerts regarding the Mode 668 collection), you must withhold numbers while the described on the recommendations for these forms.

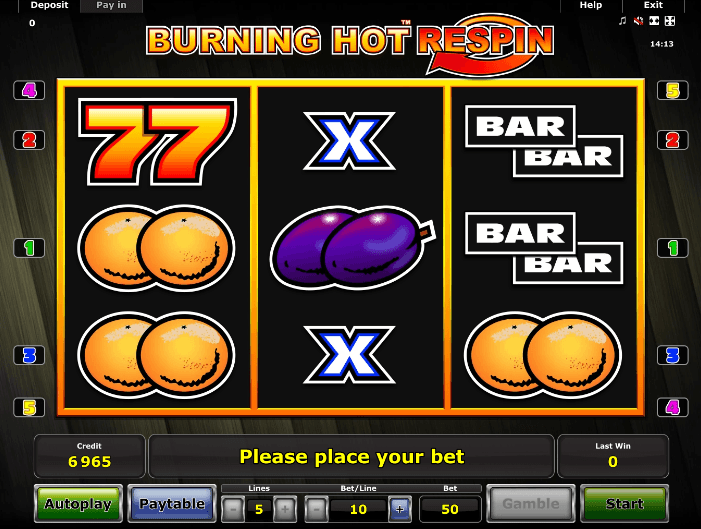

Kind of No-deposit Local casino Bonuses

When travel pay is actually addition to help you regular wages to the trips period (including, a yearly lump-contribution fee for bare travel get off), treat it while the an extra wage fee. Should your vacation shell out is for an occasion longer than their common payroll months, pass on they across the pay episodes where you spend it. A reimbursement or allotment plan try a network in which your afford the improves, reimbursements, and you may charges for their employees’ team expenditures.

Verdict: If you Is actually No-deposit Bonuses?

In case your employee brings a new Mode W-4 stating exemption out of withholding to your February 16 or after, you can even utilize it in order to future earnings but don’t refund one fees withheld as the exempt status wasn’t in place. You have to pay John Peters a base paycheck on the to begin each month. John’s most recent Form W-4 is from 2018, and you may John try single, states you to withholding allocation, and didn’t get into an amount for additional withholding to your Setting W-4. You determine to make use of the Salary Group Kind of withholding. Playing with Worksheet 3 and the withholding dining tables inside area 3 away from Club.

Can i victory whenever playing with an on-line gambling real cash no-deposit bonus?

If you’lso are a regular pro, you’ll often found a no deposit birthday added bonus regarding the function of extra money to help you wager on your chosen game. When you are no deposit incentives aren’t as well well-known for current professionals, this can be still the possibility – especially when people arrived at VIP and membership-addressed membership. Certain offers also can are entries for the competitions and other tournaments, where people can also be compete against one another to own an item of a prize pool. On-line casino prize pools can vary of $10,100 to around $one million.

Overall, it’s know that the box office share paid back to help you studios increases to 55% domestically whilst China is around 50 percent of that and you are looking at to 43% on average inside global locations. Of several major blockbusters commonly put out in the Asia, and when he could be, the fresh gross there is certainly have a tendency to brief so it will not tend to has a content influence on the general split up. Although not, it would not be member to base the package place of work payment to the research from one theater chain because they all the provides other quantities of exposure.

The fresh experiment, among other things, included which have those individuals completely colorblind anyone paint more grayscale pictures with excellent performance. Our company is along with pleased to possess the followers and you can mass media go to the unit, getting a hand-to your exposure to all of our products and discussing the news headlines. The newest ability is becoming available on the fresh XPOS® system.

Recent Comments